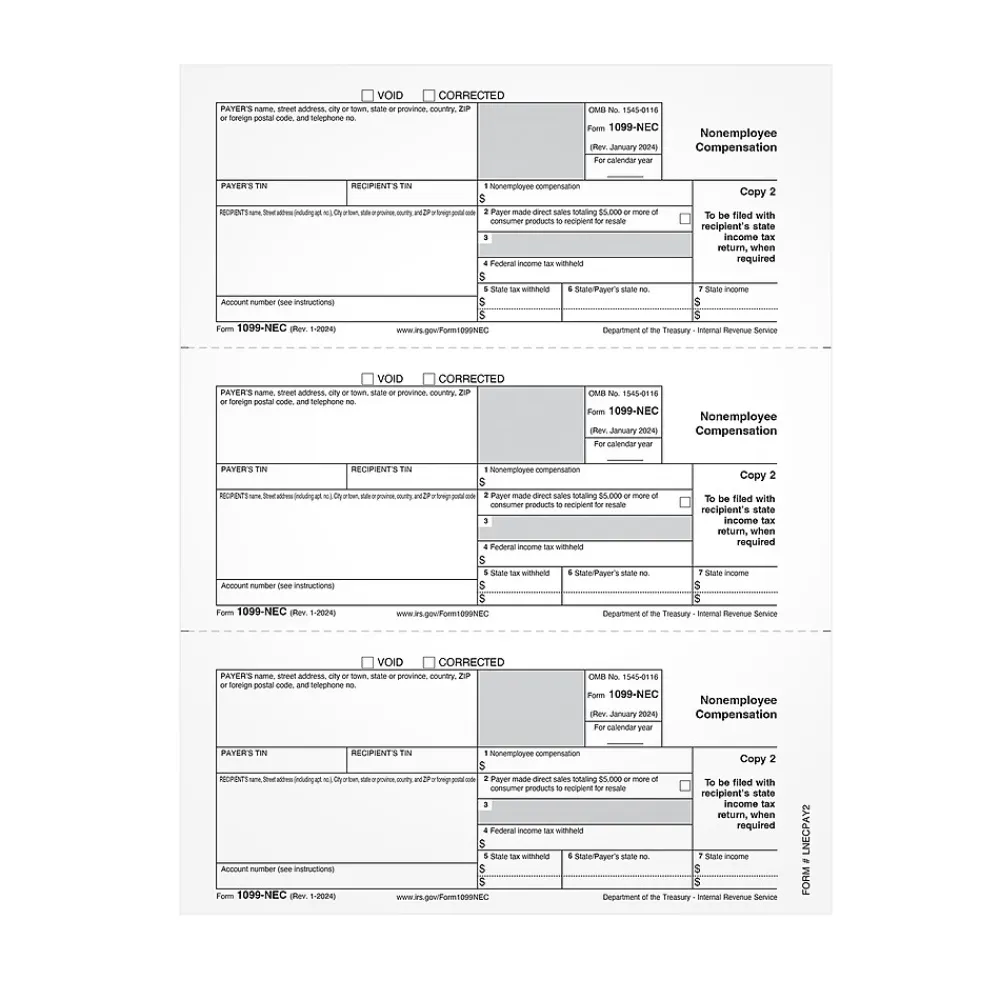

Get the forms you need to report nonemployee compensation for 150 recipients.

- 2024 1-Part 1099-NEC Copy 1/2 Forms for 150 recipients

- The 2024 1099-NEC must be mailed or eFiled to the IRS and furnished to your recipients by January 31, 2025; As of 2023, IRS eFile regulations require e-Filing for 10 or more returns of certain forms; Use the new Adams Tax Forms Helper to eFile to the IRS/SSA

- 1-Part Copy 1/2 State sheets can be used for State or Local reporting

- 3 forms per page

- Laser/inkjet printer compatible

- Sheet size 8-1/2″ x 11″; detached Size: 8-1/2″ x 3-2/3″

- Pack contains 50 1099-NEC Copy 1/2 sheets that yield 150 forms for State/Local filing

- Acid-free paper and heat-resistant inks produce smudge-free, archival-safe records

- Meets IRS specifications

- Online access to Adams Tax Forms Helper sold separately

| Attribute name | Attribute value |

|---|---|

| Length in Inches | 51+ |

| Selling Quantity (UOM) The tax year the form is applicable to. | 2023 |

| Acid Free The overall width of the product, measured left to right. | 8.5 |

| Next Day Delivery Actual manufacturer name for the color of the product. | White |

| Tax Form Type | Inkjet/Laser |

| Tax Form Pack Size | 150 |

Be the first to review “Tax Forms*Adams 2024 1099-NEC Copy 1 or 2 Laser/Inkjet Tax Forms, 50 Sheets/Pack (LNECPAY2)” Cancel reply

Related products

Sale!

Copy & Printer Paper

Sale!

Copy & Printer Paper

Sale!

Sale!

Classroom Paper

Sale!

Copy & Printer Paper

Sale!

Copy & Printer Paper

Construction Paper

Construction Paper*Crayola Construction Paper Sheets, Assorted Colors, 48/Pack (99-0036)

$4.99

Sale!

Classroom Paper

Classroom Paper*Barker Creek Happy Bright Stripe Computer Paper, 100 Sheets/Set (BC3625)

Sale!

Classroom Paper

Classroom Paper*Barker Creek Kai Ola Sea Turtles Computer Paper Pack, 100 Sheets/Set (4204)

Sale!

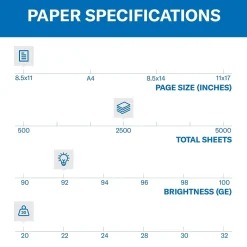

Copy & Printer Paper

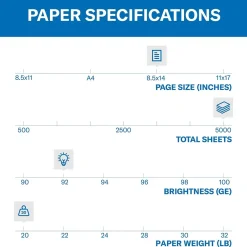

Copy Paper*EarthChoice 8.5″ x 14″ Copy Paper, 20 lbs., 92 Brightness, 500 Sheets/Ream (2702)

Sale!

Copy & Printer Paper

Reviews

There are no reviews yet.